Table of Contents

High Frequency Trading

High-frequency traders employ algorithms to look for patterns in the market and exploit them. An important part of this is Low Latency Trading which uses computers that execute trades within milliseconds. The bots that do the trading at millisecond speed are written by financial-mathematicians called Quants.

Because of their backgrounds, quants draw from three forms of mathematics: statistics and probability, calculus centered around partial differential equations, and econometrics. The majority of quants have received little formal education in mainstream economics, and often apply a mindset drawn from the physical sciences. Physicists tend to have significantly less experience of statistical techniques, and thus lean on approaches based upon PDEs, and solutions to these based upon numerical analysis.

– from Wikipedia

Often the highest paid form of Quant, ATQs (Algortimic Trading Quants) make use of methods taken from signal processing, game theory, gambling Kelly criterion, market micro structure, econometrics, and time series analysis. Algotrading includes statistical arbitrage, but includes techniques largely based upon speed of response, to the extent that some ATQs modify hardware and Linux kernels to achieve ultra low latency.

– also from Wikipedia

Dutch TV showed a great doc 'Quants the alchemists of Wall Street' see it in mediaplayer:tegenlicht (short intros are in Dutch) which claims that only a few leading ATQs understand and therefore dominate this global financial trade.

Trial and Error

design, test and trade → https://www.quantopian.com/algorithms

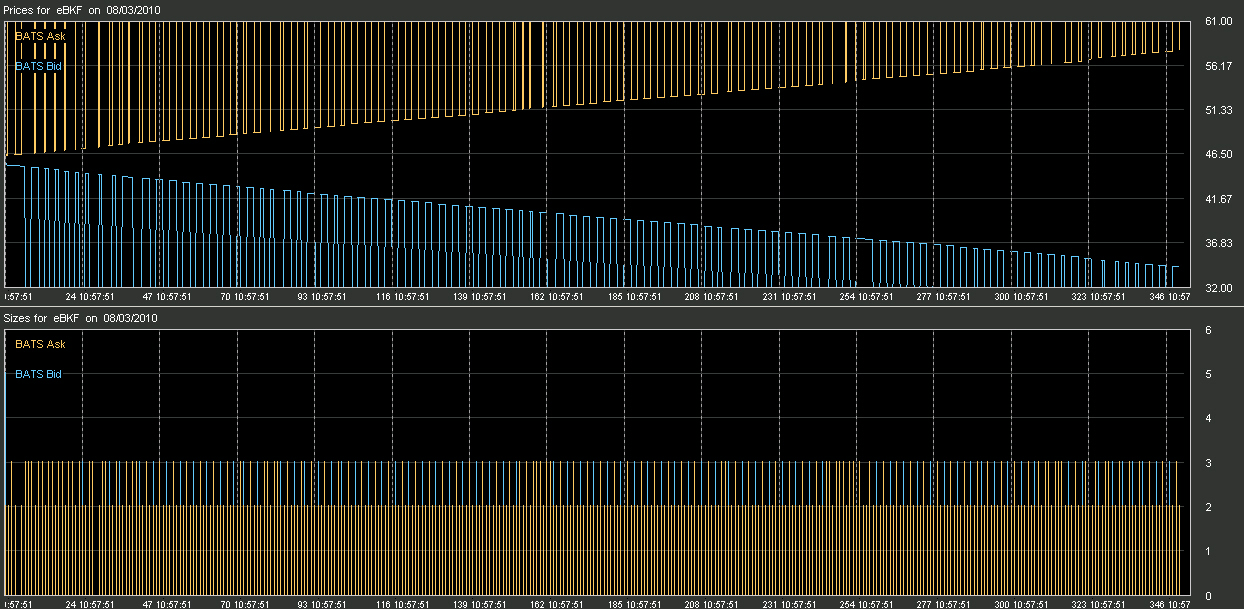

On the appearance of strange bots in HFT

But the algorithms we see at work here are different. They don't serve any function in the market. University of Pennsylvania finance professor, Michael Kearns, a specialist in algorithmic trading, called the patterns “curious,” and noted that it wasn't immediately apparent what such order placement strategies might do. Donovan thinks that the odd algorithms are just a way of introducing noise into the works. Other firms have to deal with that noise, but the originating entity can easily filter it out because they know what they did. Perhaps that gives them an advantage of some milliseconds. In the highly competitive and fast HFT world, where even one's physical proximity to a stock exchange matters, market players could be looking for any advantage. “They are moving the high-frequency services as close to the exchanges as possible because even the speed of light matters,” in such a competitive market, said Stanford finance professor Peter Hansen.

–from Market Data Firm Spots the Tracks of Bizarre Robot Traders article by Alexis Madrigal.

Accidental Art

Lightspeed not fast enough.

The latency disadvantage of globally distributed markets can't be entirely erased by technology, but the comparative lag times for international stock trades in general can be lessened by employing intermediate trading points. Alex Wissner-Gross, a physicist at the MIT Media Laboratory and Cameron Freer, a mathematician now at the University of Hawaii, propose to blanket the world with computer stations positioned along the paths between all of the major stock markets.

Securities trading companies could put semiautonomous computers at these strategic crossroads. Programmed with sophisticated buying and selling instructions these computers would act much more promptly to price signals coming from remote markets than if the signals had to travel all the way to the home office.

–from Relativistic trading: The speed of light isn't fast enough for some market transactions

the 400ms news leak

“On January 31, 2013, approximately 400 milliseconds before the official release of the EIA Natural Gas Report, trading activity exploded in Natural Gas Futures and ETFs such as UGZ, UNG and BOIL.” http://www.nanex.net/aqck2 /4090.html

“Veteran traders would usually wait in anticipation for the weekly report of gas-inventory figures by the U.S. Energy Information Administration released on Thursday at 10.30 AM and then dive into the busiest trading window of the week. This is no longer true as most traders are now staying out of the market due to the HFTs new strategy - sending floods of orders in an effort to trigger huge price swings just before the data gets released, also known as “banging the beehive”.

http://invezz.com/news/alternative-investments/625-uk-report-advises-against-more-hft-regulations